The federal tax credit for hybrid and electric cars has recently changed significantly. Many people are still determining whether the TOYOTA RAV4 HYBRID QUALIFY FOR A FEDERAL TAX CREDIT When purchasing an RAV4 Hybrid. We understand the confusion and have conducted thorough research on your behalf.

This guide will address all your rav4 hybrid tax credit tax credit questions specifically related to the RAV4 Hybrid model. Please note that this information is exclusive to the RAV4 Hybrid. If you are interested in the electric model, we recommend reading our separate article on the Toyota RAV4 Prime Tax Credit. It’s very important to know that is there a tax credit for Toyota rav4 hybrid? Our goal is to provide clear, concise answers so you can make an informed decision about your vehicle purchase.

WHAT IS THE FEDERAL EV TAX CREDIT?

The evolution of the EV tax credit over the years reflects the shifting landscape of electric vehicle adoption and government incentives. The 2022 rav4 hybrid tax credit year brings a compelling range of $2,500 to $7,500 potential savings for qualifying plug-in electric or hybrid vehicles. Navigating through the web of requirements and regulations to determine eligibility can be akin to solving a complex puzzle.

The Inflation Reduction Act adds another layer of complexity to the mix, ushering in changes from 2023 through 2032 that could significantly impact the credit landscape. Those eyeing new EVs can still revel in the promise of a substantial $7,500 maximum credit, while used EVs now offer up to $4,000 off – a compelling enticement for eco-conscious consumers on all budget fronts. As the market continues its electrifying transformation, staying abreast with these evolving guidelines is critical in harnessing this electrifying financial incentive.

QUALIFICATION STATUS

The updated regulations have put hybrid vehicles without a plug in an unfavorable position, rendering them ineligible for the federal tax credit. Among those affected by this change is the RAV4 Hybrid, which no longer qualifies for the incentive. This now means only plug-in electric and hybrid vehicles are eligible for the tax credit. For a car to qualify for these new credits, it must meet specific criteria.

- To be eligible for the credit, vehicles must have been purchased between January 2023 and December 2032 and assembled in North America.

- A new credit of $3,750 is available for vehicles with 40 or more battery minerals sourced from the U.S. or countries with a free trade agreement.

- Another $3,750 credit is designated for vehicles with 50 or more battery components from the U.S. or countries with free trade agreements.

- Vehicles must have a battery size of at least 7 kWh and a gross vehicle rating under 14,000 pounds to qualify for the credit.

- Electric vehicles under $25k are eligible for a maximum credit of $4,000.

These criteria aim to encourage the use of domestic resources and parts in manufacturing electric vehicles while also promoting affordability for consumers interested in purchasing EVs.

Vehicle qualifications are essential, but buyers must also adhere to specific rules.

- For individuals, the adjusted gross income ceiling is $150,000.

- The head of household’s adjusted gross income limit is $225,000.

- Joint filers must have an adjusted gross income of $300,000 or less.

- It’s worth noting that used EV credit guidelines have been recently updated.

These changes may affect your eligibility for certain Toyota rav4 hybrid tax credits and incentives when purchasing a used electric vehicle.

Staying informed about these regulations is crucial before making significant financial decisions.

- The EV tax credit applies for 30% of the sale price, with a cap of $4,000.

- Individuals are not allowed to buy the vehicle for resale.

- The buyer must be the original owner and cannot be claimed on someone else’s tax return.

- The purchaser must also claim another used vehicle credit in the past three years.

- Income criteria require that individuals earn less than $75,000, heads of household earn less than $112,500, and joint filers earn under $150,000.

- The sale price of the electric vehicle must be below $25,000.

- The car must be at least two years old and have a gross vehicle weight rating of less than 14,000 pounds.

- The battery capacity must meet a minimum requirement of 7 kWh.

These criteria represent essential factors when applying for a Toyota rav4 hybrid tax credit.

WHY DOESN’T IT QUALIFY?

The disqualification of the Toyota RAV4 Hybrid from plug-in hybrid tax credits highlights the intricate regulations surrounding electric vehicle incentives. Despite possessing an EV mode, it needs a plug-in capability to meet eligibility criteria. Even if the RAV4 Hybrid were a plug-in model like the RAV4 Prime, it would still need to catch up due to battery manufacturing standards.

This reveals the stringent nature of regulations governing tax credits for electrified vehicles, providing an important reminder that not all hybrids are created equal in terms of incentives and emissions benefits.

WILL TOYOTA RAV4 HYBRID QUALIFY FOR A FEDERAL TAX CREDIT IN THE FUTURE?

The eligibility of the Rav 4 hybrid tax credit presents a complex predicament, given the current stringent guidelines and regulations. The requirement for gas-powered hybrids to plug in for charging to qualify puts the RAV4 Hybrid at a disadvantage.

Despite being manufactured predominantly in the Georgetown plant in Kentucky and partially in Ontario, Canada, sourcing minerals and battery components from US or free trade suppliers remains a potential challenge that Toyota must address. Shifting resources to meet these requirements may prove arduous, pushing Toyota towards focusing on developing electric vehicles (EVs) that align with the federal EV credit criteria.

As regulations evolve, we’ll likely see Toyota concentrating more on producing well-positioned EVs to benefit from future tax incentives.

Considering the manufacturing locations and complexities associated with meeting eligibility criteria, it seems feasible that Toyota will redirect its efforts toward developing EV models poised to qualify for federal tax credits in an increasingly stringent regulatory landscape. This shift could fuel innovation within Toyota’s EV lineup and potentially open new opportunities for consumers seeking environmentally friendly vehicles with additional financial incentives.

Navigating evolving regulations will require proactive adaptations from automakers like Toyota, signaling a potential transition towards prioritizing electric vehicle development as they anticipate changes related to federal tax credits.

ALTERNATIVES THAT QUALIFY

If you’re hesitant about buying an RAV4 Hybrid due to uncertainty about the Rav 4 hybrid tax credit, consider exploring other vehicle options. Don’t worry; numerous alternatives qualify for the federal tax credit.

Vehicles Qualifying for the Full $7,500 Tax Credit

Cadillac LYRIQ (2023-2023)

- Luxury midsize SUV

- Up to 312 miles of range

- Available all-wheel drive

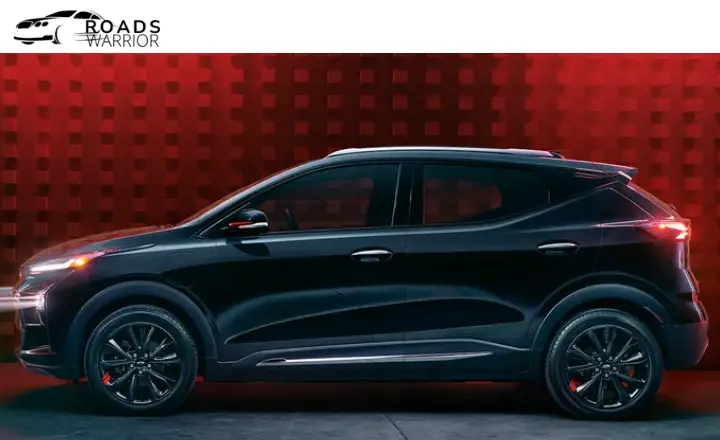

Chevrolet

- Blazer EV (2024) – Midsize SUV with up to 320 miles of range

- Bolt (2022-2023) – Compact hatchback with 259 miles of range

- Bolt EUV (2022-2023) – Subcompact crossover SUV with 247 miles of range

- Equinox EV (2023) – Compact SUV with up to 300 miles of range

- Silverado EV (2024) – Full-size electric pickup with 400 miles of range

Ford F-150 Lightning (2022-2023)

- Full-size electric pickup

- 230-320 miles of range

- Available all-wheel drive

- Towing capacity up to 10,000 lbs

Tesla

- Model 3 Long Range (2023) – Midsize sedan with 358 miles of range

- Model 3 Performance (2022-2023) – High-performance midsize sedan, 315 miles range

- Model Y Long Range & Performance (2022-2023) – Midsize crossover SUV, up to 330 miles range

Volkswagen

- ID.4 (multiple trims, 2023) – Compact crossover SUV with up to 323 miles of range

- ID.4 AWD Pro & Pro S (2023) – ID.4 with 295 miles of range and AWD

Vehicles Qualifying for a $3,750 Tax Credit

- Ford Mustang Mach-E (2022-2023) – Crossover coupe SUV with 270-300 miles range

- Rivian R1S & R1T (2023) – Electric truck and SUV with 314+ miles of range

As alternatives, these cover a range of EV sizes and styles. Consider your budget, utility needs, preferred features, and performance to choose what fits best. The RAV4 Hybrid is still a solid choice if it best suits your needs, even without the tax credit.

OTHER WAYS TO SAVE

The federal tax credit is not available for the RAV4 Hybrid, but you can still find ways to save on your purchase.

- Begin by checking for special deals and incentives from Toyota and any state or local tax incentives available for purchasing an RAV4.

- Consider using an RAV4 quote sourcing service to find the best deals in your area and save time on research.

- Pay cash for the car to save on loan interest and potentially negotiate a better deal with the dealer.

- Compare prices from multiple sellers, including options for used RAV4 Hybrids, to ensure you get the best value.

- If you own a car, explore using it for trade-in credit towards your new RAV4 purchase to offset the cost further.

- Consider waiting until the market cools down if you’re not in immediate need of a new vehicle, as this may lead to better pricing and offers in the future.

CONCLUSION

The RAV4 Hybrid is a top SUV, even without the federal tax credit. Its reasonable price, superior fuel economy, and impressive interior make it a compelling choice for drivers seeking a reliable and efficient vehicle. While some may have hoped for the tax credit with other Toyota models, the new guidelines have limited rebate eligibility.

Once you experience the benefits of the RAV4 Hybrid firsthand, you’ll likely find that the lack of an extra monetary incentive is inconsequential. So take it for a test drive and see why this SUV is worth every penny.