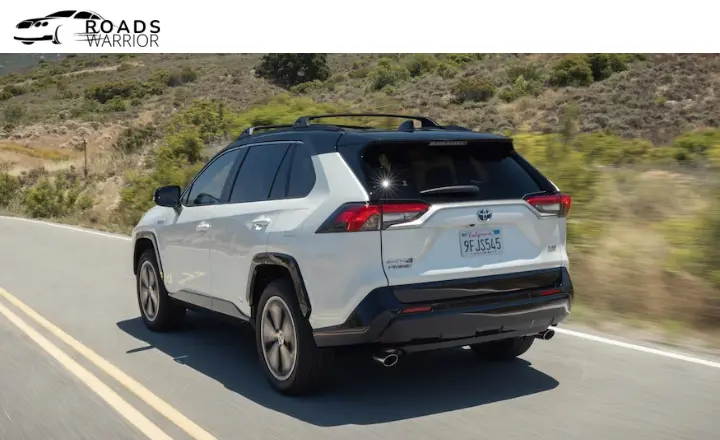

Are you ready to maximize the financial benefits of owning an electric or hybrid vehicle? As the world shifts towards more sustainable transportation options, it’s only natural to seek out every possible tax rebate and incentive for your EV or hybrid. The landscape of federal tax credits is constantly changing, leaving many drivers wondering about their eligibility and potential savings. If you’ve seen the Toyota RAV4 Prime, you may be curious whether the RAV4 PRIME qualifies for A FEDERAL TAX CREDIT in 2024.

Surprisingly, the RAV4 Prime does not qualify for the federal tax credit this year due to its final assembly location outside North America. So, what does this mean for prospective buyers and current owners? Join us as we dive into the rav4 prime tax credit status details and explore recent changes that could impact your financial decisions. Whether you’re considering a purchase or staying informed about electric vehicle incentives, this guide is essential for anyone interested in maximizing their savings with the Toyota RAV4 Prime.

WHAT IS THE FEDERAL EV TAX CREDIT?

2010 the U.S. government introduced the federal electric vehicle tax credit, offering up to $7,500 for new electric vehicle purchases. This incentive allows qualifying buyers to deduct up to $7,500 from their tax liability. While it doesn’t result in a cash refund, it can significantly lower the purchaser’s taxes. Certain restrictions apply. For instance, once an automaker sells 200,000 electric vehicles, the tax credit begins to phase out.

Tesla and General Motors have already reached this limit, rendering their vehicles ineligible for the credit. Toyota also hit this cap in June 2022 and would have seen the credits phase out by October 2023 without further intervention. Although in 2023, the 200,000 limit was removed, additional restrictions were implemented as well, according to IRS.gov.

TAX CREDIT QUALIFICATION STATUS

Tax credit for Rav4 prime up to $7,500 provides an excellent incentive for buyers interested in this hybrid vehicle. Due to reaching the 200,000 vehicle sales threshold, it no longer qualifies for this credit as per the established phase-out process.

Despite having initially qualified until October 2023, new legislation introduced by President Biden in August 2022 changed the rules. The Inflation Reduction Act limited federal EV tax credits to vehicles with final assembly in North America, disqualifying the RAV4 Prime due to its production in Japanese plants.

This change impacted the previous rebates offered on the RAV4 Prime and other models from Toyota. Potential buyers must know these developments when considering their purchase options and factoring in potential incentives or tax credits.

- The 2021-2022 Toyota RAV4 Prime qualified for a $7,500 federal tax credit if purchased before September 30, 2022. For the remainder of 2022, it qualifies for a $3,750 credit.

- The 2012-2014 Toyota RAV4 EV qualified for a $7,500 federal tax credit if purchased before September 30, 2022. For the remainder of 2022, it qualifies for a $3,750 credit.

- The 2017-2022 Toyota Prius Prime qualified for a $4,502 federal tax credit if purchased before September 30, 2022. For the remainder of 2022, it qualifies for a $2,251 credit.

- The 2012-2015 Toyota Prius Plug-in Hybrid qualified for a $2,500 federal tax credit if purchased before September 30, 2022. For the remainder of 2022, it qualifies for a $1,250 credit.

- The 2023 Toyota bZ4X Plug-in Electric qualified for a $7,500 federal tax credit if purchased before September 30, 2022. For the remainder of 2022, it qualifies for a $3,750 credit.

- Although Toyota models are no longer eligible for federal tax incentives, state and local rebates may still be available:

- Many states offer rebates on EVs and hybrids through local electric companies and other programs.

It’s wise to research regional incentives in your area before purchasing a qualified Toyota hybrid or electric model. Local rebates can make these vehicles more affordable.

WHY DOESN’T RAV4 PRIME QUALIFY FOR A FEDERAL TAX CREDIT?

The Inflation Reduction Act has brought significant changes for vehicles seeking federal rebates. Toyota’s RAV4 Prime was disqualified due to needing to be assembled in North America. This highlights the increased regulations and scrutiny on manufacturers looking to qualify for federal tax credits. With conditions now requiring vehicles to meet specific criteria, it’s evident that the landscape for incentives and rebates has shifted dramatically.

The fact that Toyota currently manufactures the RAV4 Prime in Japan underscores the impact of these new regulations on global production strategies. Assembled in North America is now crucial in determining eligibility for federal tax credits, demonstrating a clear shift towards boosting domestic manufacturing efforts. It will be interesting to see how this impacts other international manufacturers and their investment decisions regarding production locations.

The rules for vehicles assembled in North America that qualify for federal tax credits have changed. Here are the new requirements:

- Income limits:

- Single filers must make $150,000 or less per year

- Joint filers must make $300,000 or less per year

- Vehicle price caps:

- Sedans must cost $55,000 or less

- SUVs, trucks, and vans must cost $80,000 or less

- Used vehicles have a $25,000 price cap, regardless of type

- Battery materials and construction:

- Batteries must contain a certain amount of materials from North America or a US free trade partner

- Vehicles must be assembled in North America

- As of now, no electric vehicles meet these strict new guidelines

- Starting in 2024:

- EV tax credits can be received directly from the dealership during purchase

- Customers will no longer need to wait for tax returns to get the credit

WILL IT QUALIFY IN THE FUTURE?

The prospect of the RAV4 Prime becoming eligible for tax credits in the future hangs in a delicate balance. While removing the 200,000 vehicle production limit in 2023 offers some hope for Toyota, the challenges remain significant. Establishing new battery manufacturing facilities in North Carolina and Michigan by 2025 may position the RAV4 Prime to meet eligibility criteria. Relocating the final assembly to North America comes with hefty costs and plant modifications. Even if feasible, other qualifications may still need to be improved, making it a challenging decision for Toyota whether pursuing these changes is worth their time and resources.

As we look towards the future, it becomes evident that while there is potential for qualification under certain circumstances, this path has complexities. With several factors needing consideration – from production limits to assembly locations and stringent qualifications the question of whether the RAV4 Prime will qualify remains layered and uncertain. Toyota faces a multi-faceted challenge in navigating these requirements and determining whether investing in substantial changes would yield sufficient benefits within current conditions.

ALTERNATIVE VEHICLES THAT QUALIFY FOR THE CREDIT

If your are still in thinking about does the rav4 Prime qualify for tax credit, you may be looking at other options that do. The good news is that some tremendous alternative vehicles eligible for the $7,500 tax credit are available.

Vehicles Qualifying for Full $7,500 Credit

- 2022-2023 Chrysler Pacifica PHEV

- 2022-2023 Lincoln Aviator Grand Touring (PHEV)

These two vehicles currently qualify for the maximum $7,500 federal tax credit.

Vehicles Qualifying for Partial $3,750 Credit

- 2024 BMW X5 xDrive50e (PHEV)

- 2022-2023 Ford Escape Plug-In Hybrid (PHEV)

- 2022-2023 Jeep Grand Cherokee PHEV 4xe

- 2022-2023 Jeep Wrangler PHEV 4xe

- 2022-2023 Lincoln Corsair Grand Touring

The vehicles listed above currently qualify for a reduced federal tax credit of $3,750. Check fueleconomy.gov for the most up-to-date details.

Considerations When Choosing an Alternative Vehicle

If you decide to go with an alternative option to take advantage of the tax credit incentives, keep in mind that:

- Features, styling, and reliability ratings may differ

- The RAV4 Prime may still be the best option if you like its specific features and design

Even though these other vehicles qualify for credits, the RAV4 Prime has the advantages that might make it worth purchasing regardless. As you explore your options, consider what factors are most important to you.

IS IT STILL WORTH BUYING?

Given the expired tax credit, the RAV4 Prime’s higher price point may deter some potential buyers. The Prime’s actual value extends beyond fuel efficiency and cost savings. Its advanced technology, efficient powertrain, and unique position within Toyota’s lineup make it a compelling choice for those seeking innovation and sustainability. While it’s understandable that the absence of a tax incentive may give pause to some consumers, it’s essential to consider the overall package that the RAV4 Prime offers.

The long waitlists for this model also reflect its desirability among consumers, indicating that many still see worth in its features despite the lack of a tax credit. Considering current market conditions with limited rebates available for any vehicle, the RAV4 Prime stands out as an exceptional investment in forward-thinking automotive technology, even without credit. As such, it’s crucial to assess short-term costs and long-term benefits when contemplating whether or not the RAV4 Prime is still worth buying. You can read more that IS THE RAV4 HYBRID WORTH IT?

OTHER WAYS TO SAVE ON YOUR PURCHASE

Are you still considering the RAV4 Prime? I understand why. While you may not be eligible for the tax credit, other avenues exist to help save money on this fantastic vehicle.

- Due to high demand, Toyota’s special deals and incentives for the RAV4 Prime are rare.

- Check for state or local tax incentives to save even more money on your purchase potentially.

- Consider paying in cash to avoid accruing interest on a loan, ultimately saving you money in the long run.

- Compare prices from various sellers, including those offering used RAV4 Primes, to find the best deal for your budget.

- Utilize your old car as a trade-in credit towards purchasing a new RAV4 Prime.

Conclusion

The question is rav4 Prime eligible for tax credit has been thoroughly examined, and the answer is no. Despite its impressive hybrid technology and eco-friendly features, the RAV4 Prime does not meet the criteria set forth by federal regulations to qualify for a tax credit.

This disappointing outcome may impact potential buyers hoping to take advantage of financial incentives when purchasing this vehicle. It’s essential for consumers to stay informed about changes in tax credit eligibility and to explore other ways to reduce their environmental impact through alternative means of transportation or energy-efficient upgrades.